2022 International activities

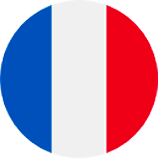

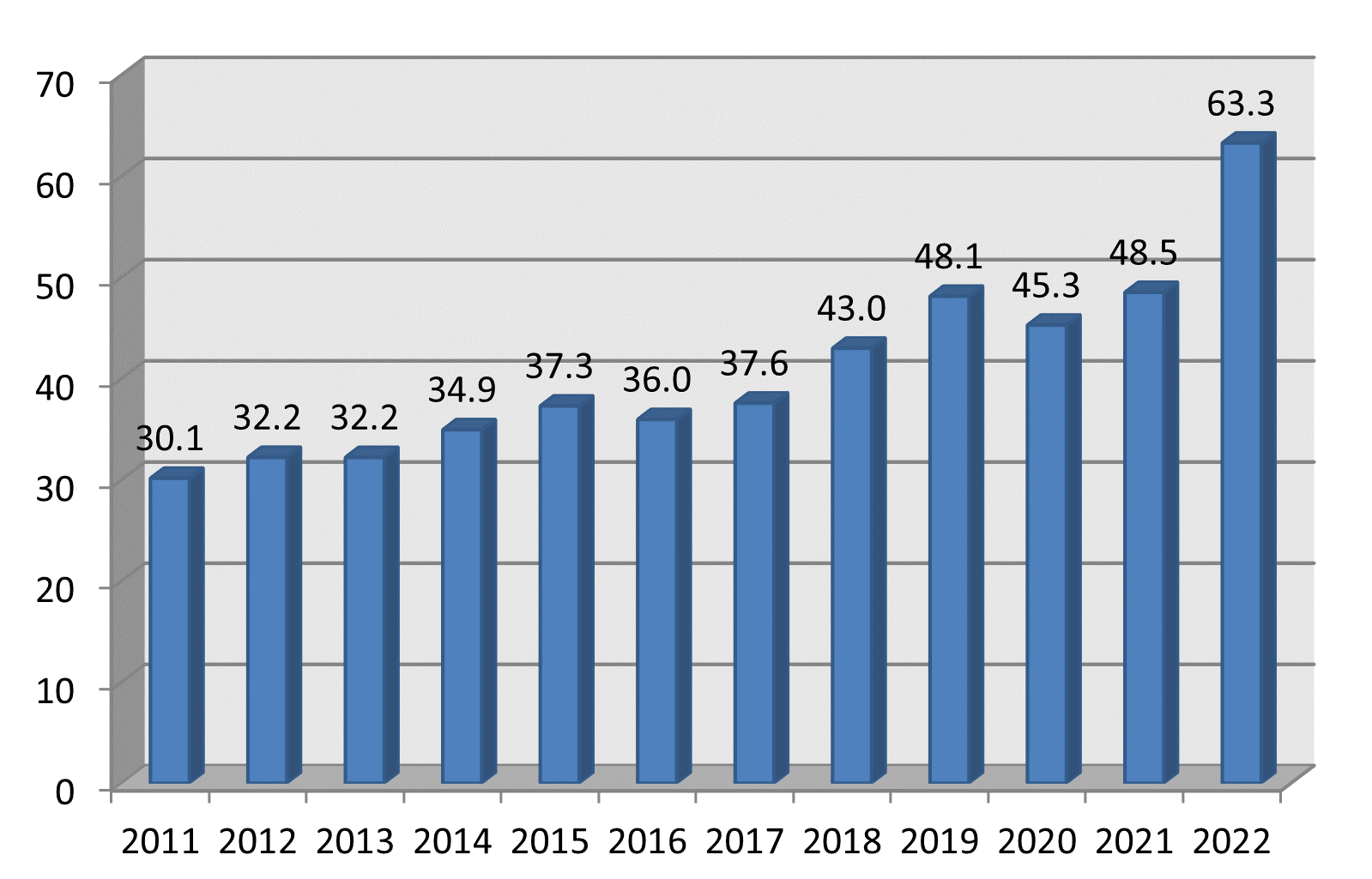

Despite the deterioration of the economic situation at the global level in 2022 – a sharp decline in economic growth and an increase in inflation – the international activities of the main French construction groups increased spectacularly in 2022 (+30.4%), to reach a turnover of €63.3 billion.

Unprecedentedly, the share of international activities of French construction companies represents more than half (53.8%) of their total turnover in 2022.

This dynamism should not hide the difficulties that construction groups faced in 2022, of varying intensity depending on the region: supply problems, tensions on the prices of materials, labor shortage, increase in inflation and interest rates.

With the exception of Asia where the turnover fell very slightly (-0.2%), the international turnover of French groups is up in all other zones in 2022: +32.5% in Europe, +22.2% in North America, +12.3% in Asia/Oceania thanks to the vitality of the Oceanian market, +3.7% in Africa, +55.4% in Latin America and +16.3% in the Middle East.

In Western European countries (EU 14 + United Kingdom), which represent the main outlet for French groups in Europe, the turnover increased by 39.6%, fueled by the dynamism of the British market. In the CEECs, with the improvement in the economic situation in many countries, the turnover increased by 15%. Finally, in other European countries (excluding the UK), the turnover also recovered with an increase of 8.1%.

Since the 2008 recession, the ranking of the main outlets, without having experienced extreme upheavals, has evolved slightly:

Since the 2008 recession, the ranking of the main outlets, without having experienced extreme upheavals, has evolved slightly:

- Europe remains the primary market for French groups with 60.9% of their total international sales in 2022 (i.e. €38.5 billion);

- North America has been in 2nd position since 2012 with a turnover of €10.4 billion (i.e. 16.4% of international turnover);

- Asia/Oceania has been ranked 3rd since 2015, ahead of Africa. The turnover reaches €5.6 billion (or 8.8%), divided between €3.4 billion for Oceania and €2.2 billion for Asia;

- Africa, which occupied the third market until 2014, is in 4th place (€4.2 billion, or 6.7% of international turnover);

- the position of Latin America (€3.8 billion, or 6% of international turnover) has remained unchanged for 7 years, in 5th place;

- the Near and Middle East ranks 6th in sales (€798 million, or 1.2% of international turnover in 2022).

The evolution of the geographical distribution of the international turnover of French construction groups has been characterized in recent years by:

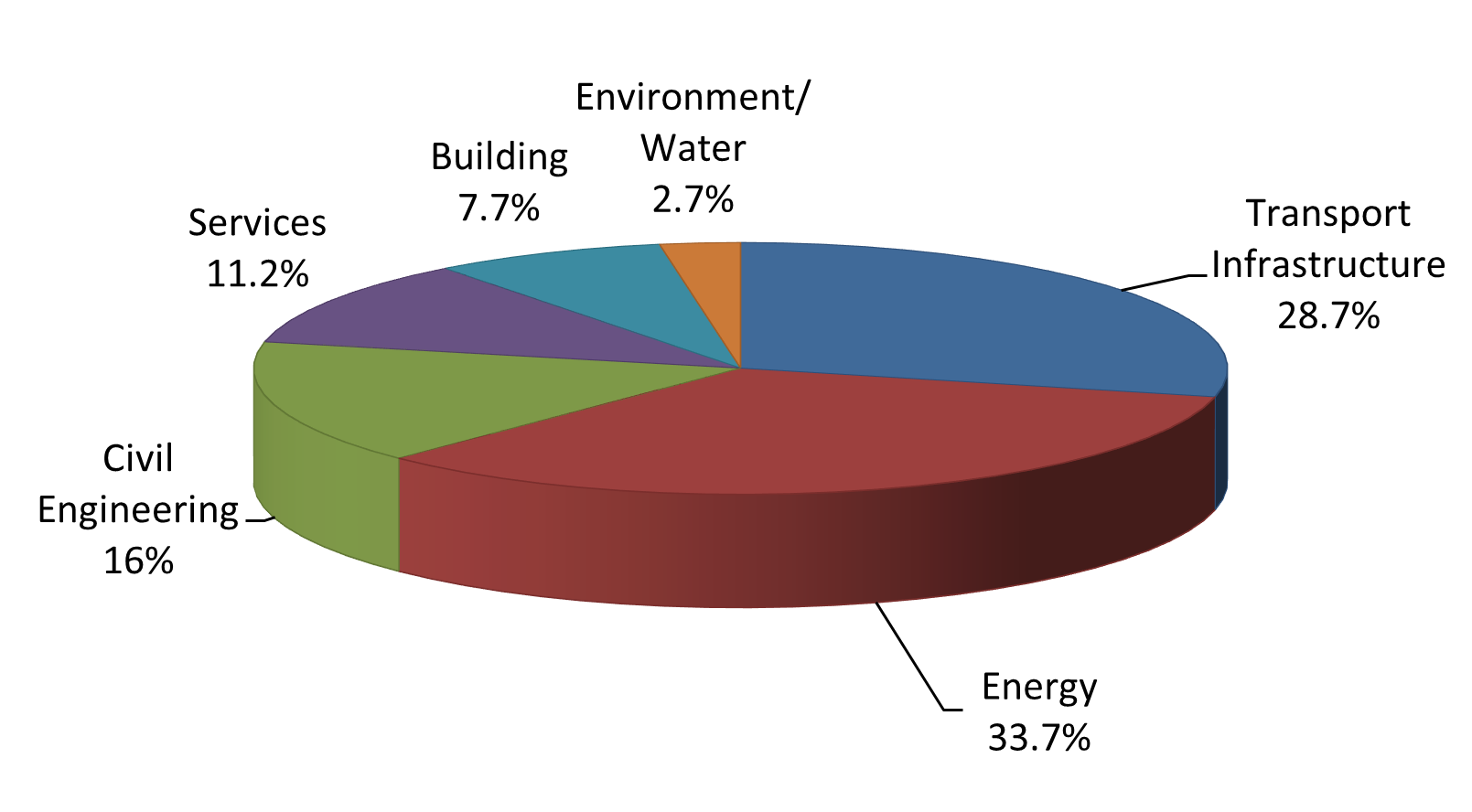

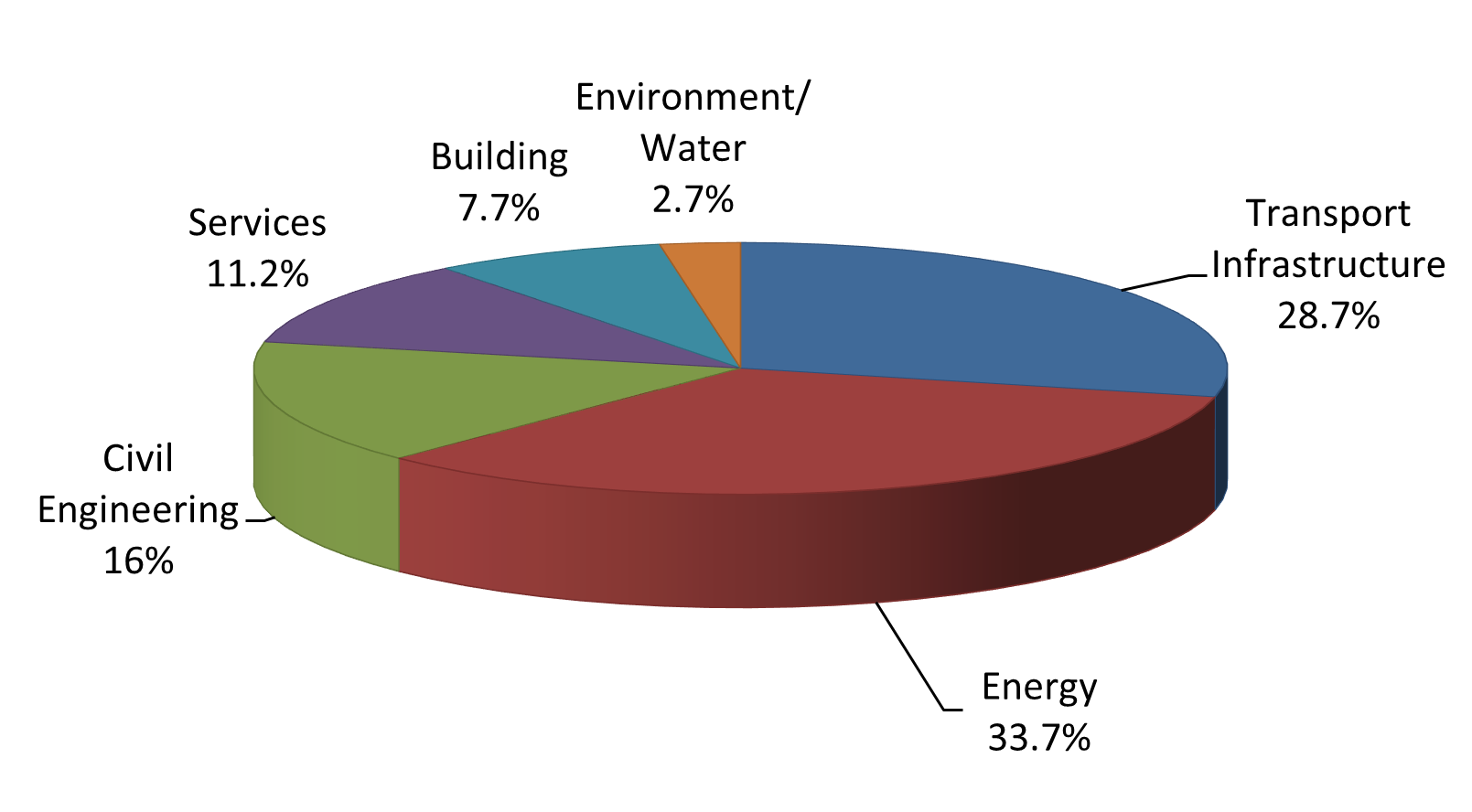

The takeover of Cobra IS by the Vinci group propels the energy sector to the forefront of activities for French construction groups in 2022 with 33.7% of their total international turnover (i.e. €21.3 billion). Transport infrastructure, which until now constituted their main sector of activity, move to 2nd place with 28.7% (i.e. €18.2 billion), followed by civil engineering with 16% (€10.1 Bn), services with 11.2% (€7.1 Bn), building with 7.7% (€4.9 Bn) and environment/water (2.7%).

The takeover of Cobra IS by the Vinci group propels the energy sector to the forefront of activities for French construction groups in 2022 with 33.7% of their total international turnover (i.e. €21.3 billion). Transport infrastructure, which until now constituted their main sector of activity, move to 2nd place with 28.7% (i.e. €18.2 billion), followed by civil engineering with 16% (€10.1 Bn), services with 11.2% (€7.1 Bn), building with 7.7% (€4.9 Bn) and environment/water (2.7%).

With the exception of the building and environment/water sectors, the international turnover achieved in all other areas of activity saw a spectacular increase in 2022, whether in energy (+52.5%) , services (+39.9%), civil engineering (+29.5%) or transport infrastructure (+23.7%). In the building sector, the turnover fell slightly (-1.5%), due to the contraction of the residential market, linked to rising interest rates.

The evolution of the sectoral breakdown over the past few years is characterized by the following:

2022 International turnover (in billions of euros)

Unprecedentedly, the share of international activities of French construction companies represents more than half (53.8%) of their total turnover in 2022.

This dynamism should not hide the difficulties that construction groups faced in 2022, of varying intensity depending on the region: supply problems, tensions on the prices of materials, labor shortage, increase in inflation and interest rates.

With the exception of Asia where the turnover fell very slightly (-0.2%), the international turnover of French groups is up in all other zones in 2022: +32.5% in Europe, +22.2% in North America, +12.3% in Asia/Oceania thanks to the vitality of the Oceanian market, +3.7% in Africa, +55.4% in Latin America and +16.3% in the Middle East.

In Western European countries (EU 14 + United Kingdom), which represent the main outlet for French groups in Europe, the turnover increased by 39.6%, fueled by the dynamism of the British market. In the CEECs, with the improvement in the economic situation in many countries, the turnover increased by 15%. Finally, in other European countries (excluding the UK), the turnover also recovered with an increase of 8.1%.

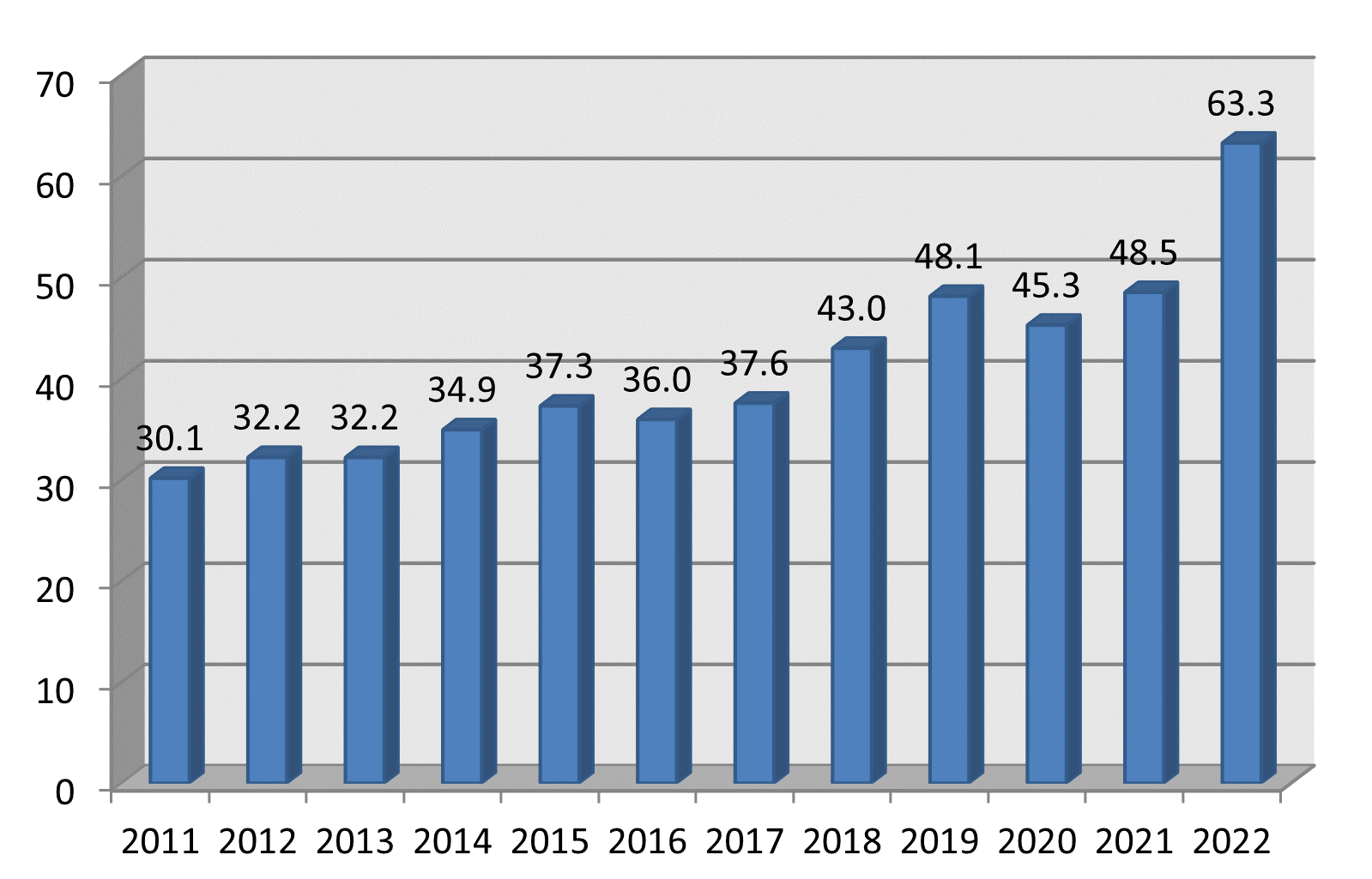

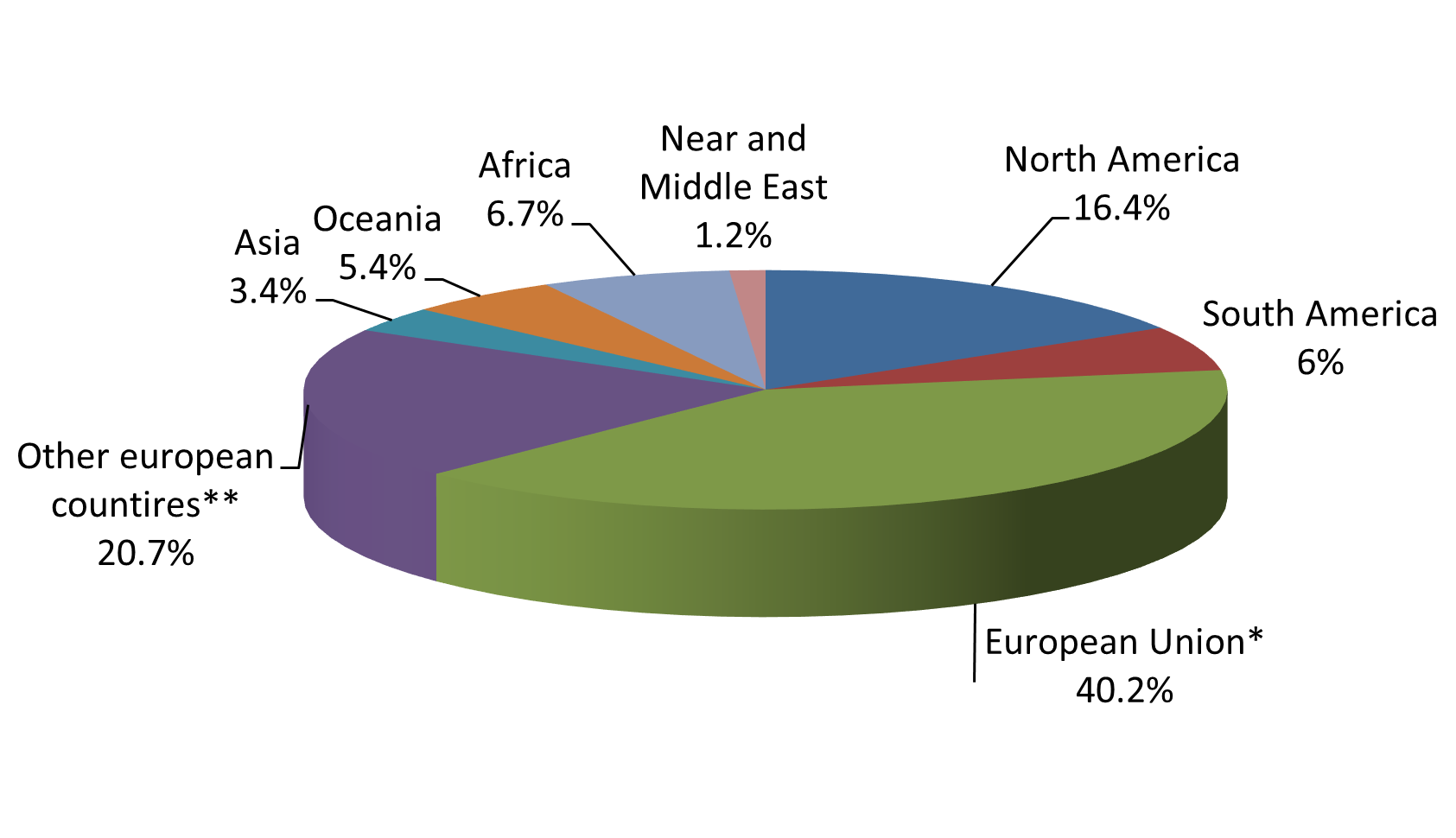

Breakdown of 2022 International turnover by geographical area (in %)

- Europe remains the primary market for French groups with 60.9% of their total international sales in 2022 (i.e. €38.5 billion);

- North America has been in 2nd position since 2012 with a turnover of €10.4 billion (i.e. 16.4% of international turnover);

- Asia/Oceania has been ranked 3rd since 2015, ahead of Africa. The turnover reaches €5.6 billion (or 8.8%), divided between €3.4 billion for Oceania and €2.2 billion for Asia;

- Africa, which occupied the third market until 2014, is in 4th place (€4.2 billion, or 6.7% of international turnover);

- the position of Latin America (€3.8 billion, or 6% of international turnover) has remained unchanged for 7 years, in 5th place;

- the Near and Middle East ranks 6th in sales (€798 million, or 1.2% of international turnover in 2022).

The evolution of the geographical distribution of the international turnover of French construction groups has been characterized in recent years by:

- the preponderance of international activities on the European continent: if this phenomenon increased between 2002 and 2006 under the effect of the integration of the CEECs within the European Union, the share of this region still represents more than half of the groups' international turnover (60.9% in 2022). Since the 2008 crisis, the weight of new entrants has declined significantly and the business volume depends largely on Western European countries. With the United Kingdom's exit from the EU, the weight of the "other European countries" category jumped from 13.5% in 2020 to 34% in 2022, taking into account the strong presence of French groups in this country;

- a solid foothold in North America: it has been the second largest market for French groups since 2012 and the weight of North America makes it one of their priority areas of operation. After a significant increase in their turnover in 2018 and 2019, linked to external growth operations, followed by a slight contraction in 2020 due to the pre-electoral context and the health crisis, the level of activity has been increasing sharply for two years, under the effect of the various recovery plans adopted in the United States and Canada, where the needs in the infrastructure sector are immense;

- resilience in Africa: in an exacerbated competitive context, and after a clear decline in activity between 2014 and 2018, the turnover has returned to growth for two years. If the share of this region was greater than 10% until 2016, it is gradually declining, representing only 6.7% in 2022;

- the rise of Oceania: thanks to the takeovers of local companies carried out by French groups in recent years, the share of this region has been greater than 5% since 2018. Under the combined effect of development of activities and reduction of turnover in Asia for several years, the sales’ level in Oceania has exceeded the one achieved in Asia for two years;

- a diversified geographical presence: while many European players in the construction sector have gradually refocused their international activities around 2-3 markets, the French groups have always maintained a diversified geographical presence over the years, despite economic hazards and political instability which weakens certain regions of the world. In addition to their lasting interest in Africa where they continue to generate a significant volume of their sales, they have significantly increased their business volume in Latin America in recent years. Finally, more recently, they have considerably increased their activities in Oceania, multiplying their external growth operations. In the Middle East, although their activities contracted sharply between 2015 and 2021, the trend seems to be reversing.

Breakdown of 2022 International turnover by activity (in %)

With the exception of the building and environment/water sectors, the international turnover achieved in all other areas of activity saw a spectacular increase in 2022, whether in energy (+52.5%) , services (+39.9%), civil engineering (+29.5%) or transport infrastructure (+23.7%). In the building sector, the turnover fell slightly (-1.5%), due to the contraction of the residential market, linked to rising interest rates.

The evolution of the sectoral breakdown over the past few years is characterized by the following:

- the growing share of energy, which represents 33.7% in 2022, compared to less than 5% until 2005. Numerous external growth operations have been carried out by French groups in this sector since 2018, and especially in the last two years. The acceleration of the energy transition offers numerous opportunities in the short and medium term, both in terms of energy production and distribution;

- the fundamental weight of transport infrastructure (a little less than a third of the overall volume). Although the increase in turnover since 2015 is not as dynamic as in certain other areas of activity (such as energy and services), this sector still presents a strong growth potential;

- the growth in services: this sector (which includes facility management and concessions), which reaches 11.2% in 2022, has experienced major growth rates since 2018. After a strong impact in 2020, linked to the global pandemic, the turnover has been up sharply again for two years. Beyond the economic and political uncertainties, this sector is an important focus of the development strategy of the French groups;

- the significant reduction in the share of the building sector over the past 10 years: while it represented a little more than 20% until the early 2000s, it stands at 7.7% in 2022, its lowest level.